Treasury FMS 7600B 2012-2025 free printable template

Show details

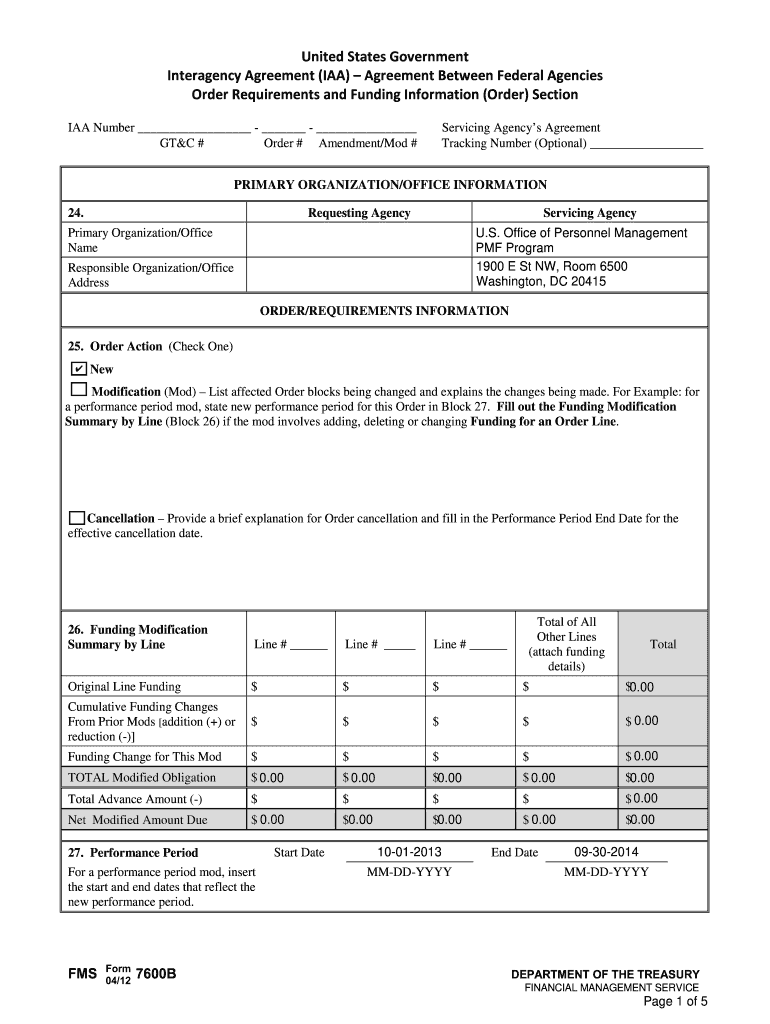

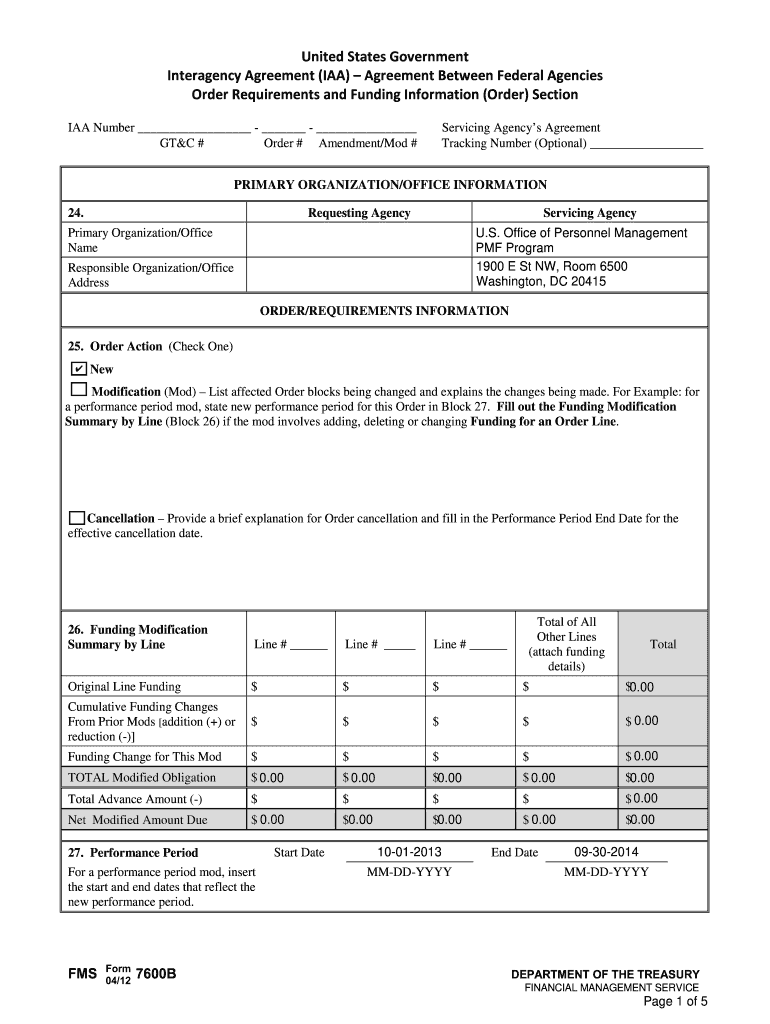

RESET FORM United States Government Interagency Agreement (IAA) Agreement Between Federal Agencies Order Requirements and Funding Information (Order) Section IAA Number — GTC # Order # Amendment/Mod

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign 7600b order requirements form

Edit your federal agencies form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your information agreement required form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing 7600b fillable online

Follow the steps below to use a professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit treasury 7600b form. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out 7600b form

How to fill out Treasury FMS 7600B

01

Obtain a blank Treasury FMS 7600B form from the official website or financial institution.

02

Fill out the legal name of the agency or organization at the top of the form.

03

Provide the address of the agency or organization.

04

Enter the unique identifier or registration number assigned to the agency or organization.

05

Complete the section detailing the type of payment requested.

06

Review the terms and conditions on the form thoroughly.

07

Sign and date the form where indicated.

08

Submit the completed form to the appropriate Treasury Department office.

Who needs Treasury FMS 7600B?

01

Any federal agency or organization that requires access to federal funds or payment services from the Department of the Treasury.

02

State and local governments seeking federal assistance or grants.

03

Business entities working with the federal government that need to manage payments or finances.

Fill

interagency agreements

: Try Risk Free

People Also Ask about 7600b information

What is FS form 7600B?

FS FORM 7600B INSTRUCTIONS. Agreement Between Federal Program Agencies for Intragovernmental Reimbursable, Buy/Sell Activity.

What is the difference between 7600A and 7600B?

Collectively, the standard Interagency Agreement (IAA) form is comprised of two sections: (1) the 7600A serves as the General Terms and Conditions (GT&C) form and (2) the 7600B serves as the Order Requirements and Funding Information (Order) form.

What is 7600 EZ?

7600EZ will be a new API (Application Program Interface) & UI (User Interface) process that will transfer funds through G-Invoicing.

Who signs the 7600B?

The Servicing Agency Funding Official signs to start the work, and to bill, collect, and properly account for funds from the Requesting Agency, in ance with the agreement.

What is the difference between FS form 7600A and 7600B?

Collectively, the standard Interagency Agreement (IAA) form is comprised of two sections: (1) the 7600A serves as the General Terms and Conditions (GT&C) form and (2) the 7600B serves as the Order Requirements and Funding Information (Order) form.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit federal agency in Chrome?

Get and add pdfFiller Google Chrome Extension to your browser to edit, fill out and eSign your fs form 7600b, which you can open in the editor directly from a Google search page in just one click. Execute your fillable documents from any internet-connected device without leaving Chrome.

How do I fill out the 7600b pdf form on my smartphone?

Use the pdfFiller mobile app to fill out and sign additional information required on your phone or tablet. Visit our website to learn more about our mobile apps, how they work, and how to get started.

How do I edit treasury 7600b information on an Android device?

You can. With the pdfFiller Android app, you can edit, sign, and distribute treasury 7600b form from anywhere with an internet connection. Take use of the app's mobile capabilities.

What is Treasury FMS 7600B?

Treasury FMS 7600B is a form used by Federal agencies to request the transfer of funds between the U.S. Department of the Treasury and other federal accounts.

Who is required to file Treasury FMS 7600B?

Federal agencies that wish to transfer funds as part of their financial operations are required to file Treasury FMS 7600B.

How to fill out Treasury FMS 7600B?

To fill out Treasury FMS 7600B, agencies need to provide information such as the requesting agency, the amount to transfer, the purpose of the transfer, and other relevant details as specified in the instructions on the form.

What is the purpose of Treasury FMS 7600B?

The purpose of Treasury FMS 7600B is to facilitate the transfer of funds between federal entities, ensuring that federal agencies can efficiently manage their financial transactions.

What information must be reported on Treasury FMS 7600B?

Information that must be reported on Treasury FMS 7600B includes the agency name, transfer amount, purpose of the funds, and other specifics related to the financial transaction.

Fill out your Treasury FMS 7600B online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Federal Agency Agencies is not the form you're looking for?Search for another form here.

Keywords relevant to treasury iaa form

Related to audits verification

If you believe that this page should be taken down, please follow our DMCA take down process

here

.